The Fama-French method is a widely used model in portfolio management. Developed by Nobel laureate Eugene Fama and researcher Kenneth French, the model expands on the Capital Asset Pricing Model (CAPM) by adding two factors: size and value. Here is how you can use the Fama-French method in real-life portfolio management. To see more information about the FF method itself, we wrote an article on it before, which you can find on our website’s blog section.

Understanding the Fama-French Model

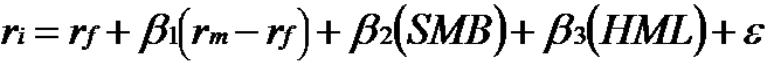

The Fama-French model considers three factors: the market return, the size of firms (small minus big, or SMB), and the book-to-market ratio (high minus low, or HML). The model is expressed as follows:

- Ri is the return of the portfolio or stock.

- Rf is the risk-free rate.

- βm, βs, and βh are the sensitivities of the returns to the three factors (coefficients)

- Rm is the market return.

- SMB represents the firm size premium

- HML represents the value stocks’ premium over growth stocks

- εi is the constant

Applying the Fama-French Model in Portfolio Management

Risk Assessment

The Fama-French model aids in determining the risk of a portfolio. You can comprehend how different characteristics of the market can affect your portfolio by studying the three factors. For instance, if your portfolio has high βs (coefficient), it means it is more sensitive to the performance of small-cap stocks.

Portfolio Construction

When constructing a portfolio, the Fama-French model can guide the selection of assets. Suppose you believe that small-cap stocks will outperform large-cap stocks. In that case, you should tilt your portfolio towards assets with a high SMB factor (According to several studies, it is correct that small-cap stocks usually outperform others). Similarly, if you believe that value stocks will outperform growth stocks, you should tilt your portfolio towards assets with a high HML factor.

Performance Attribution

The Fama-French model can also be used to explain a portfolio’s performance. By decomposing the portfolio’s return into the three factors, you can understand what drove the portfolio’s performance. For example, if your portfolio outperformed the market, was it because of its exposure to small-cap stocks, value stocks, or both?

Limitations of the Fama-French Model

While the Fama-French model is a powerful tool, it’s not without limitations. It assumes that markets are efficient (as many other models do as well), which is not always the case in real life. Moreover, the model is based on historical data, and as the saying (and the disclaimer for this article) goes, “past performance is not indicative of future results.”

Also, it is quite insufficient for predicting trend stocks which grow a lot with momentum. Thus, it makes the Fama-French model more of a “buy-hold” type of strategy.

Real-life Examples

We will not use real names or stocks since we do not want to endorse or advise buying or selling any of these companies, so the names are anonymized for theory purposes. This will be on how the Fama-French model might be applied to hypothetical stocks.

As the disclaimer goes again, it is important to note that these are just expectations based on the Fama-French model. Real-life returns can be influenced by various factors and may not always align with the model’s predictions. Always do your research or consult with a financial advisor before making investment decisions. Or, you can be more wise and use the Analytical Platform to enhance your investment returns while minimizing risk.

Let’s consider these five hypothetical companies:

- SmallCapValue Inc.: SmallCapValue Inc. is a small-cap company with a high book-to-market ratio, which means it falls into the “small size” and “high value” categories. If the Fama-French model is correct, this company would be expected to provide higher returns over the long term, as both the SMB (Small Minus Big) and HML (High Minus Low) factors would be positive.

- BigCapGrowth Corp.: BigCapGrowth Corp. is a large-cap company with a low book-to-market ratio, falling into the “big size” and “low value” categories. According to the Fama-French model, this company would be expected to provide lower returns over the long term, as both the SMB and HML factors would be negative.

- MidCapBlend LLC: A mid-cap company with a moderate book-to-market ratio. This stock falls into the “medium size” and “medium value” categories. Its returns are expected to be somewhere in between SmallCapValue Inc. and BigCapGrowth Corp.

- InternationalValue Ltd.: A small-cap company based outside of the US with a high book-to-market ratio. This stock adds international exposure and potential value premium to the portfolio. (Despite being a European company ourselves, we acknowledge that the stock market in the US is a completely different thing than what it is in the EU. Thus we provide more US-oriented examples and analysis.)

- BigCapValue Co.: A large-cap company with a high book-to-market ratio. This stock is expected to provide the value premium (due to a high HML factor) but not the size premium (due to a negative SMB factor).

The exact allocation among these stocks would depend on the investor’s risk tolerance, investment horizon, and beliefs about market conditions. For instance, an investor who believes strongly in the Fama-French model and is willing to take on more risk for the potential of higher returns might allocate more to SmallCapValue Inc. and InternationalValue Ltd.

Yet even if you are a complete devout believer of this model we still have something to say; despite putting a heavier emphasis on these 2 companies we still suggest adding a few stocks of other companies to diversify your total portfolio. You can also use our factor investing software to build strategies based on factor investing.

Conclusion

In conclusion, the Fama-French method provides a more nuanced view of the market and portfolio performance by considering the size and value factors; hence, it allows for a more comprehensive risk assessment, informed portfolio construction, and detailed performance attribution. However (as we say in our articles related to other models), like any model, it should be used in conjunction with other tools (like industry trends, company fundamentals, and macroeconomic conditions) and not be relied upon exclusively.