“Best stock” is a term that is often advertised in a variety of contexts, and investors should pay close attention to how such an evaluation was made. The best stocks for dividends will probably be different than the best for growth. In fact, the process of searching for those stocks will vary greatly depending on your investment style. Whatever your style, just make sure the stock selection process matches your style and requirements.

Simply put, there are no “best stocks” in absolute terms, it always depends on context.

We are not going to list here the best stocks picked by our AI. You can find the current list for this month by signing up for the Analytical Platform free trial.

Instead, we will provide the context of how is the stock picking process done, what’s the purpose and what its intended use. This is an important context for investors, so they can decide whether the method fits their investment style, and investment horizon and whether it complements their portfolio.

Best stocks for your investment style

Every investor is different and a number of investment styles might be endless. Some investors are more conservative and prefer strategies with lower risk, while others have a higher risk appetite and willing to endure more volatility in exchange for higher returns.

Three things are often considered when figuring out a personal investment style.

Expected returns

Helps to determine how much time you will need to achieve your financial goals. According to David Bach’s 50-20 formula, $50 a day for 20 years at a 10% rate of return will make over $1 million. That is about $1500 a month you would need to invest for 20 years with compound interest. For comparison, the long-term rate of return of the well-known benchmark S&P 500 is about 8%. The S&P 500 index is considered the best in passive investing, so if your financial goals require more than 8% a year, you need to turn into active-style investment by picking individual stocks.

Risk tolerance

The amount of risk you are willing to take on in exchange for a return on your investment. Generally, investment strategies with higher risks should be rewarded with higher returns. Investors are often attracted to strategies with high returns, but when the market gets volatile, they end up selling their positions and taking a huge loss. For example, during the 2008 crisis, the aforementioned index S&P 500 lost 55% from it’s peak value in October 2007 to March 2009. You need to ask yourself how much you are prepared to lose without panicking.

Effort needed to maintain your strategy

Choose a strategy according to the effort you are willing to put into implementing the strategy. Having a strategy that fits your investment style will allow you to stay invested even when the market gets volatile and ultimately will help you achieve your financial goals. When choosing your investment strategy, it is important to backtest the strategy so you’ll determine your expected return and risk.

Stock picking AI

Stock picking is a technique that uses a systematic form of analysis to conclude that a particular stock will make a good investment. All relevant data need to be considered, such as technicals, fundamentals, ratings, sentiment indicators, insider tradings, etc. As the definition suggests, stock picking is a systematic process and what is deemed as the best today might not be tomorrow. AI greatly assists with the setup and maintenance of your strategy, significantly reducing the effort required.

The recipe is simple, determine returns and risk using backtesting, setup the strategy and stick to it.

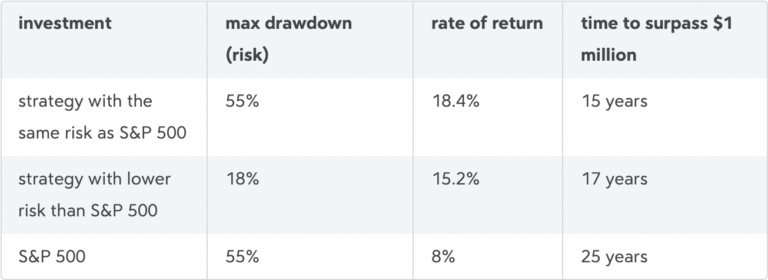

I have briefly touched on the subject of multi-factor investing in the article about AI powered investment management. With 18.4% returns, it allowed us to outperform the S&P 500 benchmark.

With respect to risk tolerance and expected returns, that particular strategy mimics the index by just picking the best stocks from the index, so the maximal drawdown is the same. Using the same example from 2008, this strategy would have lost almost 55% of its value.

There is an alternative less risky strategy, however, still based on stocks from the S&P 500. With 14% returns, it still outperforms the S&P 500 and has 3x lower drawdowns at the same time. With the example from 2008, this strategy would have lost only 18%. Using the 50-20 formula, with $1500 a month, you would surpass $1 million:

You can see the beauty of stock-picking AI. You are not reliant on just one strategy, you can model out multiple scenarios and choose the one that fits your investment style.

It’s even possible to reach $1 million in less than 15 years, providing you will be able to survive even higher drops without panicking, selling out, and accepting huge losses.

Best stocks context

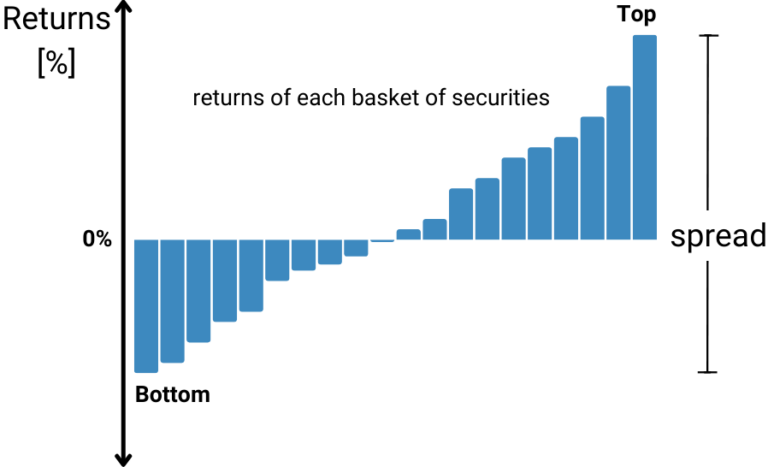

Our stock-picking system is based on multi-factor analysis. It’s trained to take the market and rank securities from the top to bottom, based on their expected risk-adjusted returns. The top ranks outperform the market and represent the best stocks, while the bottom underperforms.

The notion of the best stocks and the worst stocks is not absolute, it’s just better or worse in comparison to its peers in the current time frame. The expected use of the system is to follow the changes as they appear. The best pick today might not be the best tomorrow. The frequency of the changes depends on the machine learning model and backtesting, where we take into account achieved returns and fees paid to the broker. It would not make sense to earn less than we need to pay on fees. Our current published model runs on a monthly basis. Every month the ranking is re-adjusted and the underlying portfolio is rebalanced accordingly.

Ranking system

The ranking is depicted on the chart below.

Returns of every basket represent the average return of all securities in the basket. The basket represents a group of securities with similar exposure to factors. The value of the factors is proportional to the expected return of securities in the basket. It doesn’t matter how exactly the above chart looks like, the important measure is the spread. The bigger the spread, the better.

Based on the rank, we can easily create a portfolio by taking long on the top basket and short on the bottom basket.

As long as the top basket outperforms the bottom basket, we will make some positive returns.

As long as the spread is consistent throughout time, we will make a profit whether the market goes up or down.

The aforementioned ranking system serves as a cornerstone for building up investment strategies. A good starting point is to set up a market-neutral portfolio with 50/50 exposures to long and short. From there we can adjust our long and short exposures, adding leverage, etc. This way we can find the strategy, that fits our investment style. At Analytical Platform we can help with setting up investment strategies for your investment style. We can also help with finding the best stocks for your investment style. If you have any questions, don’t hesitate to contact-us.

Vladimir Vacula